It’s Now Easier Than Ever To Measure Natural Capital Risks

Climate risks endanger 13 of the 18 FTSE 100 sectors, and a new tool makes it possible for investors, insurers, and anyone with an interest to explore the specific risks faced by sectors, sub-sectors, and specific processes supporting the global economy.

27 November 2018 | Last week, the US government published a detailed report warning that climate change is already hitting the economy hard and will devastate it in coming decades as crops fail, fires rage, and floods rise. But how will those risks hit individual sectors?

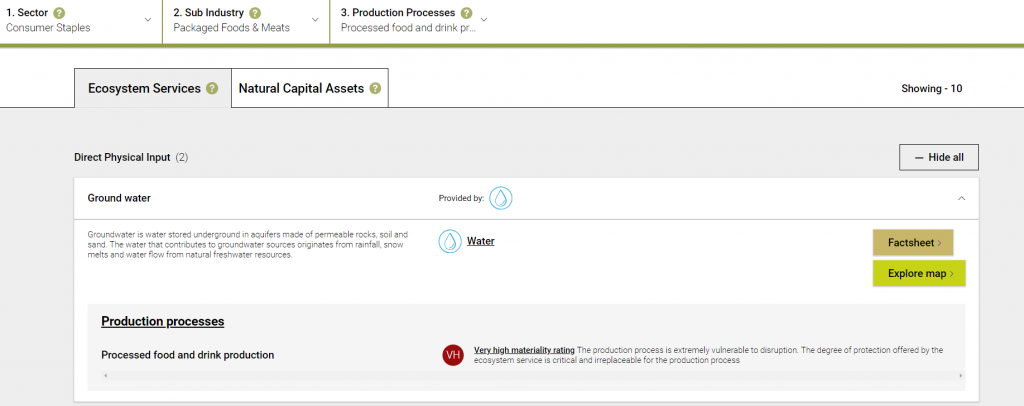

To help answer that, the Natural Capital Finance Alliance (NCFA) has launched a tool called ENCORE (Exploring Natural Capital Opportunities, Risks and Exposure), which makes it possible to explore the environmental risks associated with sectors, industries, and specific manufacturing processes – such as, for example, the exposure that the packaged foods sector faces when confronted with disruptions in water supply.

Broad Risk

The database draws on extensive data and screening criteria and covers 167 economic sectors and 21 ‘ecosystem services’, or services that healthy ecosystems provide, such as clean and reliable supplies of water, carbon sequestration, and pollination. ENCORE data has identified that the three sectors most materially dependent on nature are: Agriculture, Aquaculture & fisheries and Forest products. Sectors such as Utilities, Oil & gas and Mining were also found to have a very high dependence on ecosystem services. The three most important ‘ecosystem services’ for the global economy were found to be: Water provision, Climate regulation and Flood protection.

The tool shows that 13 of the 18 sectors that comprise FTSE 100 have high or very high material dependence on nature.

The ENCORE tool is managed by the NCFA, a collaboration between the UN Environment Finance Initiative (UNEP FI) and Global Canopy, in partnership with UN Environment World Conservation Monitoring Centre. It launches at today’s UNEP FI Global Roundtable in Paris. YES Bank, First Rand and VicSuper are among the financial institutions supporting the tool at the launch. Other NCFA signatories or institutions involved in the creation of ENCORE include IFC, UBS, National Australia Bank, Citi, UniCredit and CDC Biodiversite.

Further Reading

Banks, investors and insurers will soon be able to measure natural capital risks

Please see our Reprint Guidelines for details on republishing our articles.